Get This Report on Stonewell Bookkeeping

Wiki Article

What Does Stonewell Bookkeeping Mean?

Table of ContentsThe Facts About Stonewell Bookkeeping UncoveredStonewell Bookkeeping Can Be Fun For EveryoneGetting The Stonewell Bookkeeping To WorkUnknown Facts About Stonewell BookkeepingAbout Stonewell Bookkeeping

Here, we address the inquiry, exactly how does bookkeeping help a business? In a feeling, bookkeeping publications stand for a picture in time, however just if they are upgraded frequently.

None of these final thoughts are made in a vacuum as valid numeric information should copyright the economic choices of every small business. Such data is put together through accounting.

You know the funds that are available and where they fall short. The news is not always great, however at least you know it.

4 Easy Facts About Stonewell Bookkeeping Described

The puzzle of reductions, credit reports, exceptions, schedules, and, of course, charges, is sufficient to simply surrender to the internal revenue service, without a body of efficient documentation to sustain your claims. This is why a devoted bookkeeper is important to a local business and is worth his/her weight in gold.

Your service return makes claims and depictions and the audit focuses on confirming them (https://yamap.com/users/4989172). Excellent bookkeeping is everything about linking the dots between those depictions and reality (Low Cost Franchise). When auditors can comply with the details on a ledger to receipts, financial institution statements, and pay stubs, to name a few papers, they rapidly find out of the proficiency and integrity of the company organization

Not known Facts About Stonewell Bookkeeping

Similarly, slipshod bookkeeping includes in stress and anxiety and anxiety, it also blinds company owner's to the prospective they can realize in the future. Without the info to see where you are, you are hard-pressed to establish a destination. Only with easy to understand, thorough, and accurate information can an organization proprietor or administration group plot a program for future success.Company owner understand best whether an accountant, accounting professional, or both, is the right service. Both make vital payments to a company, though they are not the exact same profession. Whereas an accountant can gather and organize the information needed to sustain tax obligation prep work, an accountant is much better suited to prepare the return itself and truly analyze the earnings declaration.

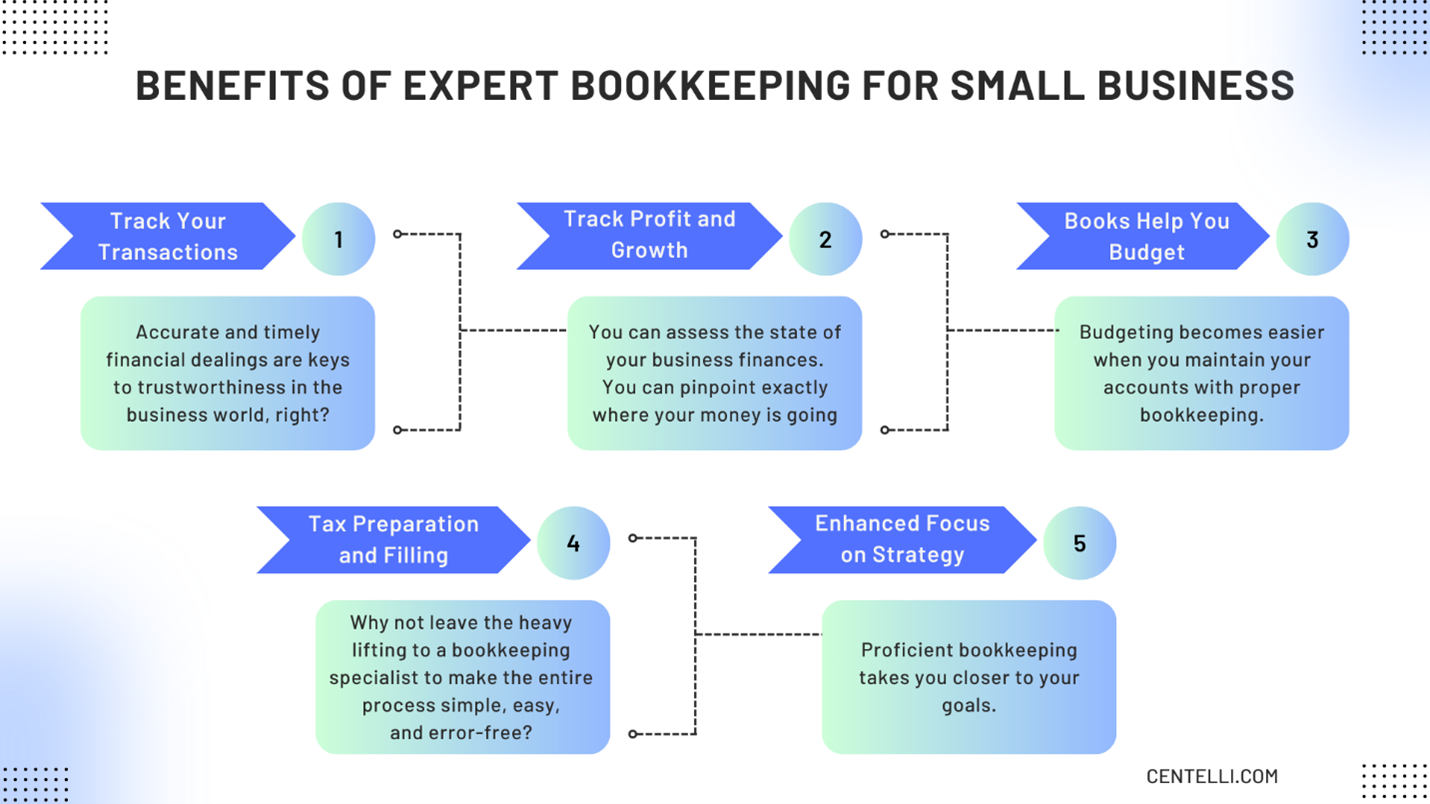

This short article will certainly explore the, consisting of the and just how it can profit your organization. We'll additionally cover exactly how to begin with bookkeeping for an audio monetary ground. Bookkeeping includes web link recording and arranging economic transactions, including sales, acquisitions, settlements, and invoices. It is the procedure of maintaining clear and concise records to ensure that all financial details is easily accessible when required.

This short article will certainly explore the, consisting of the and just how it can profit your organization. We'll additionally cover exactly how to begin with bookkeeping for an audio monetary ground. Bookkeeping includes web link recording and arranging economic transactions, including sales, acquisitions, settlements, and invoices. It is the procedure of maintaining clear and concise records to ensure that all financial details is easily accessible when required.By consistently updating economic records, accounting helps organizations. Having all the economic details conveniently obtainable maintains the tax obligation authorities completely satisfied and avoids any kind of last-minute headache during tax obligation filings. Regular accounting guarantees well-maintained and well organized records - https://profile.hatena.ne.jp/hirestonewell/profile. This aids in quickly r and conserves services from the stress and anxiety of looking for files throughout due dates (small business bookkeeping services).

More About Stonewell Bookkeeping

They are mainly worried regarding whether their cash has been made use of effectively or not. They definitely wish to know if the firm is making money or otherwise. They also would like to know what capacity business has. These aspects can be quickly handled with bookkeeping. The profit and loss statement, which is prepared on a regular basis, shows the revenues and likewise determines the possible based on the revenue.By maintaining a close eye on financial documents, businesses can establish reasonable goals and track their development. Normal bookkeeping guarantees that services remain compliant and prevent any type of penalties or legal problems.

Single-entry bookkeeping is easy and works ideal for small companies with few deals. It entails. This approach can be compared to keeping an easy checkbook. Nevertheless, it does not track properties and responsibilities, making it less detailed compared to double-entry bookkeeping. Double-entry bookkeeping, on the other hand, is extra sophisticated and is normally taken into consideration the.

8 Easy Facts About Stonewell Bookkeeping Explained

This can be daily, weekly, or monthly, relying on your company's size and the volume of deals. Don't think twice to seek assistance from an accountant or accountant if you find handling your monetary documents testing. If you are trying to find a complimentary walkthrough with the Audit Solution by KPI, contact us today.Report this wiki page